Freight News:

Loaded and Rolling: J.B. Hunt’s Q2 freight bottom-cycle blues

J.B. Hunt’s Q2 freight bottom-cycle blues

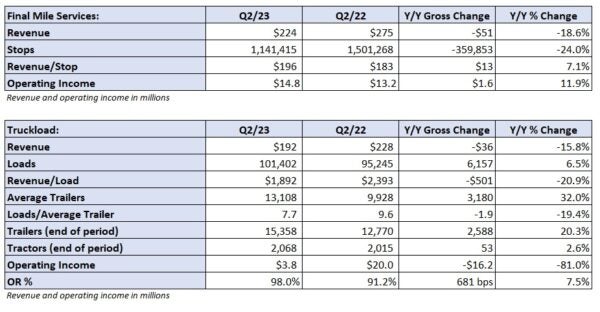

Truckload and multimodal carrier J.B. Hunt told analysts on an earnings call Tuesday that it’s still too early to tell how the 2023 peak season for freight will turn out. The company noted its Q2 declines across the board in revenue, operating income and an operating ratio that fell from 90.8% in Q2 of 2022 to 91.4% this year against a backdrop of lower volumes and softening freight demand.

FreightWaves’ Todd Maiden wrote: “Operating income per load in the intermodal segment fell again in the quarter, down 24% y/y to $284. The segment saw revenue fall 19% as loads fell 7% and revenue per load was down 13% (7% lower excluding fuel surcharges). Management said roughly 70% of renewed contract pricing had been implemented by the end of the second quarter.”

One topic that stood out was the demand outlook. Darren Field, president of intermodal at J.B. Hunt, said on the call: “Well, coming into the year, we relied heavily on customer forecasts, and they were largely all wrong. And today, we’re still a little cautious on what we expect as the year goes on.” For carriers and shippers, demand planning remains a challenge as consumer demand and behavior approach levels not seen since 2019.

Motive reports stronger Fourth of July surge but muted 2nd-half freight demand

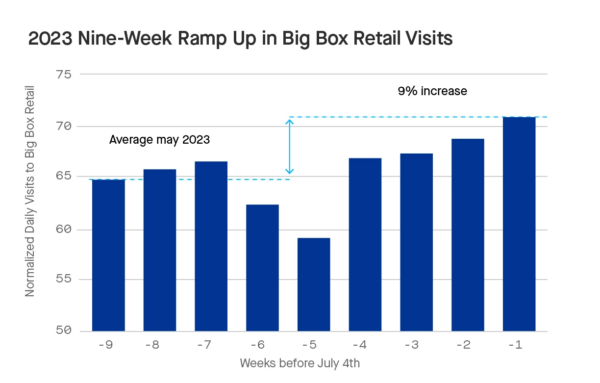

ELD and telematics provider Motive recently released its July economic report, a monthly analysis using data from over 120,000 customers and carriers that covers more than 20% of for-hire trucks in North America. Below are some highlights from the report:

- Trucking visits to top 50 retailer warehouses jumped 3% in the week leading up to July 4, marking a 9% jump since a slower-than-average Memorial Day weekend.

- Supply chain executives are bringing in inventory later, mirroring behavior seen during the 2022 holiday season.

- Retailers continue to adopt a wait-and-see approach in the current environment, suggesting a cautious outlook for consumer demand in the second half of the year.

- Despite the glimmer of hope with the Fourth of July surge, there is little optimism of demand surging back, and a muted second half is expected.

FreightWaves interviewed Hamish Woodrow, data scientist and head of strategic analytics at Motive, on Tuesday about the report’s highlights and how the retail data is impacting freight volumes. Woodrow noted that both carriers and customers continue to focus on improving visibility within their platforms to both improve asset utilization and identify pain points in their networks.

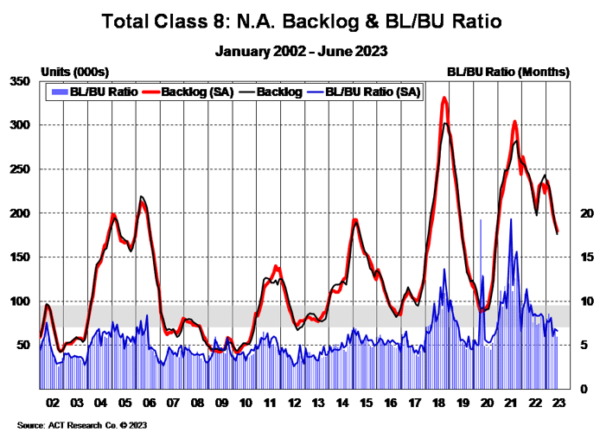

Market update: ACT Research sees Class 8 order backlog improve in June

On Wednesday ACT Research released June Class 8 orders data, which shows elevated production coupled with seasonally weak order numbers. Summertime is typically a slower time for Class 8 orders as OEMs work through existing build orders and order books for the following year resume in the fall. This allowed OEMs to catch up with production and caused the Class 8 backlog to fall 14,000 units month over month to 175,200. The backlog-to-build ratio declined 80 basis points (bps) to 5.9 months (6.6 seasonally adjusted).

Regarding the muted orders, Kenny Vieth, ACT president and senior analyst, said, “Coupling the annual seasonally weak period of orders (typically April-August) and healthy supply chains enabling elevated production, the Class 8 backlog will be on a downward trajectory until 2024 orderboards open.”

As to when 2024 order books will open, Vieth added, “Traditionally, those out-year orderboards open in October, but in recent cycles, we have seen them open as early as August.”

Fleets continue to prioritize updating aging tractors over trailers, with Vieth noting, “Meanwhile, end market demand in recent months has favored trucks over tractors. Tractor orders declined 1% y/y in June, while truck orders rose 28% y/y. Truck orders are experiencing strong tailwinds from federal legislation and manufacturing reshoring which are boosting construction spending and spurring demand for vocational equipment.”

FreightWaves SONAR spotlight: Spot-to-contract rate spread narrows

Summary: The spread between spot linehaul rates and initial contracted rates continues to narrow as contract rate declines run into a spot rate environment that appears to have found a pricing bottom. The most recent reading of 65 cents per mile in favor of contract rates follows a 14-day lag due to how contracted rates are reported and calculated. Looking ahead, spot market linehaul rates are currently at $1.65 per mile without fuel after rising to a 30-day high of $1.72 per mile during the July Fourth holiday. The narrowing spot-to-contract spread continues to place contracted freight volumes at a premium as carriers attempt to solicit and book from dedicated customers first before attempting to venture on to the spot market for fewer loads at lower rates.

Continued contract rate declines, while worrisome for truckload carriers, may expose freight brokers to additional risks. Freight brokers that enjoyed a margin buffer may run into a margin deficit if their carrier base goes out of business or negotiates for higher rates once enough excess truckload capacity leaves the market. While shippers are enjoying record levels of load tender compliance rates, carriers and brokers starved for truckload volumes continue to undercut one another until a contracted pricing floor can be reached.

The Routing Guide: Links from around the web

DAT, Convoy drop lawsuits against each other (FreightWaves)

Survey finds fewer women in commercial driver positions (Commercial Carrier Journal)

Viewpoint: Court enters huge win for freight brokerage industry (FreightWaves)

Year so far has been ‘very busy’ for regulations; there’s still more to come (Trucker News)

FMCSA denies prison inmate CDL training exemption (FreightWaves)

Teamsters issue strike notice at Yellow (FreightWaves)

Like the content? Subscribe to the newsletter here.

The post Loaded and Rolling: J.B. Hunt’s Q2 freight bottom-cycle blues appeared first on FreightWaves.

Source: freightwaves - Loaded and Rolling: J.B. Hunt’s Q2 freight bottom-cycle blues

Editor: Thomas Wasson