Freight News:

Will sanctions on Russian diesel pay off for product tankers?

European Union and G-7 sanctions on Russian crude exports kicked in Dec. 5, and contrary to predictions, crude tanker rates didn’t spike following trade disruptions. They sank.

Sanctions on Russian exports of refined products begin in just four weeks, on Feb. 5. It has been widely predicted that this will boost rates for product tankers — the ships that carry cargoes such as diesel, gasoline and jet fuel.

Some are now questioning that assumption.

Executives of Scorpio Tankers (NYSE: STNG), the world’s largest listed product tanker owner, addressed the sanctions issue and broader fundamentals during a presentation hosted by Capital Link on Monday.

Bigger product tanker impact predicted

“In the last week or two, I have been hearing a lot of people — and even one or two analysts — saying, ‘We see the VLCC [very large crude carrier] market has gone down since Russian sanctions, so why wouldn’t the product tanker market go down?” said Robert Bugbee, president of Scorpio Tankers.

“The people drawing these conclusions are wrong,” he argued.

James Doyle, Scorpio’s head of corporate development, pointed out that the EU had already replaced much of its Russian crude imports before the Dec. 5 ban was implemented. Not so with diesel.

“In fact, Russian diesel exports to Europe have increased,” Doyle said, adding, “It will be difficult to replace the 1 million barrels of Russian diesel imports that are going to Europe each day.”

Bugbee said that the sanctions disruptions to Russian crude flows, measured in ton-miles (volume multiplied by distance), are less significant than those on the product side, where the EU must replace short-haul Russian diesel flows with cargoes from China and other distant sources, and Russia must simultaneously find new buyers for its diesel.

“I think people put too much expectation on the VLCC market [improving] with regard to sanctions,“ he said. “All along, it’s the product tanker market that will benefit more.”

Jet fuel demand on the rise

Regardless of what happens with sanctions, the outlook for the supply-demand balance has rarely, if ever, been this attractive to product tanker owners.

On the demand side, China has lifted its COVID restrictions and just opened to international travel. “China opening up is going to drive up jet fuel consumption, which is a major component that’s been missing to the modern product tanker market,” said Bugbee.

Doyle noted that global refined products exports are already at record highs, averaging 25.3 million barrels per day in December. Meanwhile, inventories remain near record lows, with global distillate inventories down more than 240 million barrels over the past two years.

Bugbee said, “The world wasted the whole of last year — nobody built up their inventories and for various reasons, they got away with it.”

As a result, said Doyle, “product tankers, now more than ever, are being used to supply more immediate demand from farther afield, and we expect that to continue, especially as jet fuel picks up.”

He continued: “Seaborne exports of refined products have increased in 19 out of the 22 years since 2000 — even during the global financial crisis. Low freight-rate environments are typically due to the supply side [i.e., an oversupply of newly built ships].

“Today, it’s much different,” said Doyle. Future undersupply of ships, given limits on building new ones, “could be the most important part of the equation.”

‘Mattresses and trampolines to bounce off’

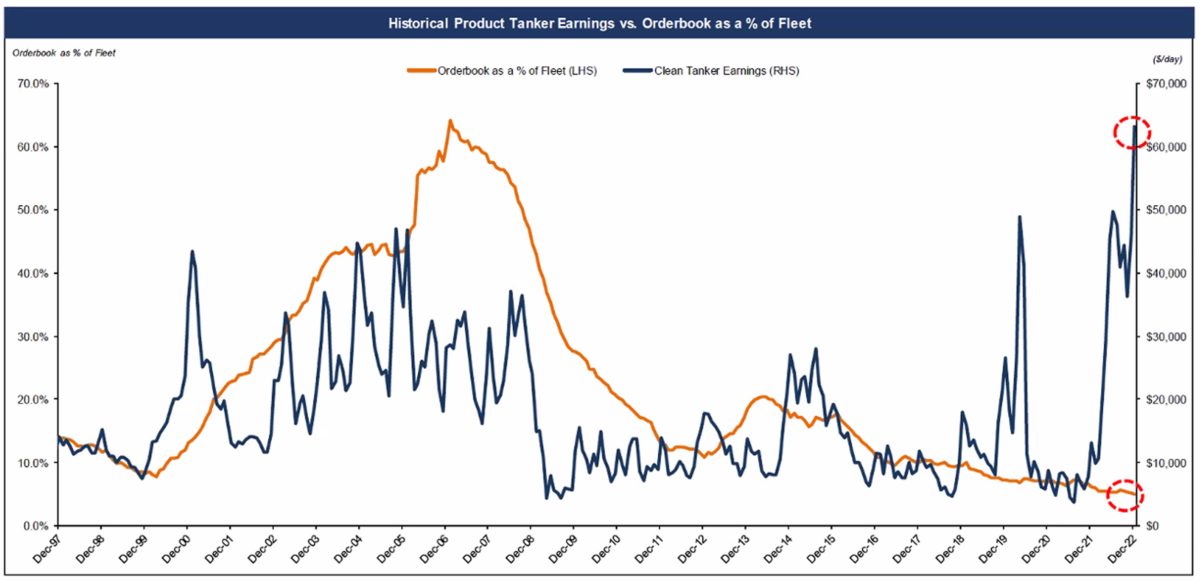

High spot rates have been accompanied in previous tanker cycles by high ordering of new ships. New tonnage eventually floods the market and depresses spot rates. This cycle is different. There continues to be virtually no ordering.

Capacity of product tankers under construction is only 4.8% of on-the-water capacity, an all-time low. Construction prices are high and shipyard slots have already been filled with orders for new container ships and liquefied natural gas carriers.

If an order for a medium-range product tanker is placed today, it couldn’t be delivered until 2025, said Doyle. A larger long-range product tanker couldn’t be delivered until 2026. “If you really wanted to significantly impact the market and order 100 ships or something, you’d have to spread it out at various yards that are already full with other projects, so you’d be looking at 2026 and after,” he said.

According to Bugbee, “Every other time in my career when we’ve had really strong rates, we’ve had the supply side growing like crazy, with a record number of ships on order. You had a demand side where everything was firing on all cylinders, but you were looking down from the top of a cliff out to a very, very large fall below you. Now, we have mattresses and trampolines to bounce off.

“We have this extraordinary phenomenon where rates are high combined with an orderbook that is at a record low,” said Bugbee.

“The supply side is not being recognized by investors or stressed enough by analysts, simply because we work in a world that is so focused on the here and now, so everybody is focused on rates here and now, as opposed to looking forward.”

Click for more articles by Greg Miller

Related articles:

- Crude tanker rates down double digits after Russia sanctions debut

- Could Russia sanctions work in practice even if they fail on paper?

- Chaos theory: How tankers thrive amid energy crisis and war

- Sanctions could lift already booming product tankers to new heights

- Crude tanker owners see dollar signs as Russia ban draws near

- Sanctions are about to slam Russia’s still-booming oil export trade

- Russia oil sanctions: How conflict with EU rules threatens G-7 price cap

- G7’s grand plan to squeeze Russia oil windfall hinges on tanker shipping

The post Will sanctions on Russian diesel pay off for product tankers? appeared first on FreightWaves.

Source: freightwaves - Will sanctions on Russian diesel pay off for product tankers?

Editor: Greg Miller