Freight News:

Werner chief says worst has likely passed

Following a very tough quarter, management from Werner Enterprises said Tuesday the worst of the freight downcycle has likely passed.

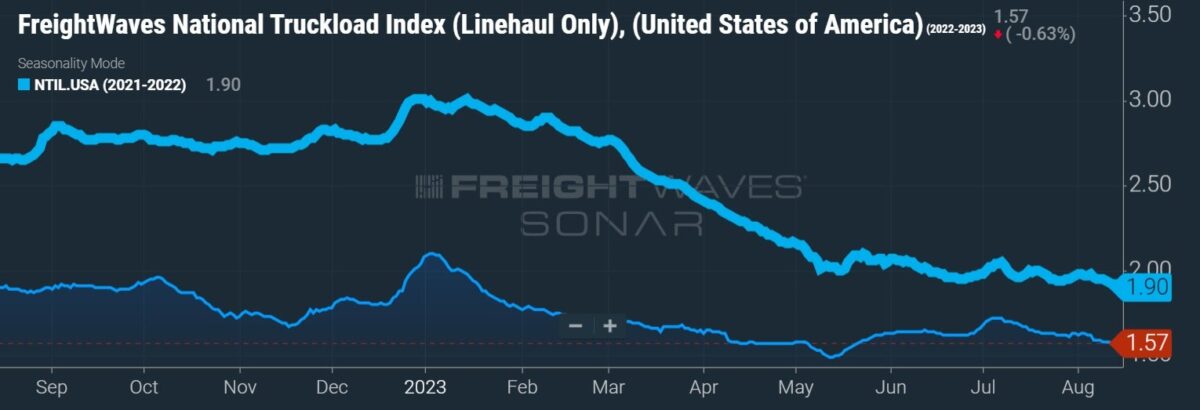

Werner’s (NASDAQ: WERN) outlook calls for a muted peak season with continued capacity attrition. Derek Leathers, the truckload carrier’s chairman and CEO, told investors at Deutsche Bank’s (NYSE: DB) transportation conference that he was surprised by the staying power spot-market-dependent carriers have had following the recent boom cycle.

“We underestimated the cash pile that small, medium-size carriers had built up over COVID and have allowed them to survive longer than we thought they’d be able to,” Leathers said. “I underestimated the resiliency of them being able to survive below their operating costs for as long as they have but I think those days are over.”

He said most of these carriers likely depleted their cash positions in June but are continuing to face soft volumes, weak spot rates and cost inflation, including fuel, which is up 16% since the beginning of July. He believes many are selling underutilized equipment to stay afloat.

Werner is also seeing the end of a long stretch of inventory destocking from its customers, which overcorrected following supply chain disruptions and stockouts two years ago. Most of Werner’s customers have indicated they expect a “normal replenishment cycle” moving forward.

The comments line up with recent data compiled in a survey of supply chain executives. The Logistics Managers’ Index displayed the fastest pace of inventory decline in its 6.5-year history during July. The inventory reading was 41.9, a notable level of contraction and well below a neutral threshold of 50. Wholesalers (37.5) made better progress lowering stock levels during the month than retailers (51.4).

“I think the opportunity for the worst to be behind us is increasingly clear,” Leathers said.

Werner recorded a “very tough [second] quarter,” missing consensus expectations like many of its peers. A lack of seasonal improvement during the period, as previously anticipated, has forced analysts to reel in expectations for the rest of the year.

The third quarter is also expected to be tricky as Werner has completed bid season on another 25% of its accounts. Weaker contract rates will be in place on the majority of the company’s book of business during the quarter.

However, revenue per total mile in its one-way segment was down just 5% year over year (y/y) in the second quarter, which was better than most carriers in the industry. Management said it walked away from some opportunities during bid season, opting to place more trucks in the spot market, essentially banking on a recovery sooner than later.

The company’s guidance calls for a 4% to 7% y/y decline in one-way rate per mile in the third quarter. Werner’s dedicated business is expected to hang on to slight increases in revenue per truck per week going forward.

Gains on equipment sales were a 10 cent headwind (on a 52 cent number) in the second quarter. Declines in used equipment prices along with slowing cost inflation will remain obstacles. However, Werner has identified more than $40 million in cost-saving opportunities, roughly 40% of which have already been implemented. Most of these initiatives likely represent permanent cost reductions.

Management said its one-way segment has experienced a downturn for the last 18 months and that it doesn’t expect rates to stay negative for a second straight year.

When the market does turn, Werner plans to approach future pricing negotiations with a keen memory of which shippers honored contractually agreed to rates and which shippers chose to jump to the spot market to take advantage of depressed prices.

“I will absolutely remember Q2 … very well … for a long time,” Leathers said. “We were treated very well by some folks and a large swath of our customers stood up and they were who they said they were, others were not. We will respond appropriately because to not do so would be inappropriate to those customers that stood tall during this time and they deserve us to reciprocate positively with them.”

Leathers is hopeful for a “slow, gradual recovery in 2024.” However, that call is dependent on consumer spending holding up, retailers having already rightsized inventories and a continued slowing in inflation.

More FreightWaves articles by Todd Maiden

- Freight market staying ‘lower for longer,’ Cass says

- Forward Air merges with Omni Logistics, will target expedited LTL

- XPO to ramp up capacity to fill Yellow void

The post Werner chief says worst has likely passed appeared first on FreightWaves.

Source: freightwaves - Werner chief says worst has likely passed

Editor: Todd Maiden