Freight News:

Shipping stocks in the crosshairs as China fears mount

What’s bad for China is bad for ocean shipping stocks. China is pivotal to tanker and dry bulk demand, as well as to containerized cargo flows.

Analysts have been touting the reopening of China’s economy following COVID lockdowns as a positive catalyst for shipping stocks. Not only has that not happened but COVID cases in China have spiked — with 40,000 cases reported Sunday — and Chinese citizens have taken to the streets to protest lockdowns.

As concerns about Chinese demand and a global recession mount, the price of oil is falling, and with it, the price of tanker stocks. “Hopes earlier this month that China would eventually relax its zero-tolerance approach to COVID seem unfounded,” warned tanker brokerage BRS on Monday.

Meanwhile, container shipping shares continue to fall and dry bulk shares remain in limbo.

Tanker stocks just off highs

According to Clarksons Securities analyst Frode Mørkedal, rates for very large crude carriers fell 16% last week compared to the week before. “Crude tanker equities generally fell along with oil prices,” he added in a research note Monday.

Shares of crude-tanker owners Nordic American Tankers (NYSE: NAT) and Euronav (NYSE: EURN) fell 4% and 6%, respectively, on Monday. Share prices of crude- and product-tanker owners International Seaways (NYSE: INSW) and Frontline (NYSE: FRO) dropped 4% and 6%, respectively. Shares of product-tanker owners Scorpio Tankers (NYSE: STNG) and Ardmore Shipping (NYSE: ASC) both fell 4%.

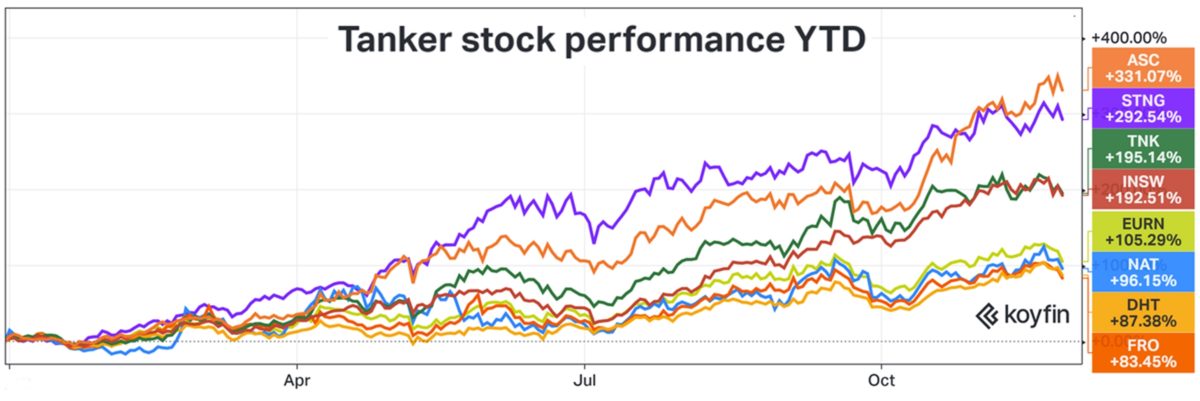

However, the recent pullback needs to be put in context. Most tanker shares are up triple digits year to date (YTD) and were at or near 52-week highs only a week ago.

U.S.-listed tanker stocks have segregated into three levels of performance. The pure product-tanker players are at the top, with Scorpio Tankers up 293% YTD and Ardmore Shipping up 331%, according to data from Koyfin.

In the middle bracket are mixed-fleet owners International Seaways and Teekay Tankers, both up close to 200% YTD.

The other large tanker names, including Euronav, Frontline, Nordic American Tankers and DHT (NYSE: DHT), are up in the range of 83-105% YTD.

Furthermore, the recent mini-pullback for tanker shares comes before a potentially large positive catalyst for demand measured in ton-miles (volume multiplied by distance): The EU will ban imports of Russian crude on Dec. 5 and Russian petroleum products on Feb. 5, requiring replacement imports to travel much longer distances.

No relief for container shipping stocks

Container spot freight rates continue to decline. The Drewry global composite index shed another 7% last week, dropping to $2,404 per forty-foot equivalent unit.

That’s down 77% from the peak in September 2021 albeit still 82% higher than the 2019 average, pre-pandemic.

According to Stifel analyst Ben Nolan, there has been “no holiday relief for container shipping. Every quarter from here is likely to decline for all liner companies until sometime into the undefined future.”

Among the U.S.-listed container shipping stocks, vessel-leasing companies Euroseas (NASDAQ: ESEA), Danaos (NYSE: DAC) and Global Ship Lease (NYSE: GSL) are down 21-26% YTD. These companies have leases in place to protect against market downside until those contracts expire.

Liner stocks have fared worse. Matson (NYSE: MATX) is down 30% and Zim (NYSE: ZIM) — by far the worst performer among larger shipping names in 2022 — is down 64% YTD. Zim shares dropped 7% on Monday, hitting a new 52-week low.

Dry bulk shares leveraged to China outcome

According to Mørkedal, “If China reverses its COVID policy and removes restrictions … we expect dry bulk shipping to be the primary beneficiary when considering all shipping sectors.”

The implied flipside is that dry bulk companies have the most to lose if China’s woes deepen.

Rates for larger Capesizes bulkers averaged $13,800 per day as of Monday, according to Clarksons. That’s up 48% week on week, but still below the average breakeven for Capesizes 10 years or younger and well below the 2022 high of $38,200 per day in late May.

Dry bulk shares rose during the first five months of the year, hitting highs in late May and early June. As spot rates retreated, dry bulk shares gave back their gains over the following four months, hitting lows in late September. After holding fairly steady in October, they rose moderately in the early November but have fallen back in recent trading sessions.

As of Monday, Eagle Bulk (NASDAQ: EGLE) was still up 11% YTD and Golden Ocean (NASDAQ: GOGL) was up 1.5%. Diana Shipping (NYSE: DSX) was down 6% YTD. Star Bulk (NASDAQ: SBLK) and Geno Shipping & Trading (NYSE: GNK) were down 9%. Safe Bulkers (NYSE: SB) was down 25% YTD.

Dry bulk stocks, like tanker and container stocks, were under pressure on Monday. Safe Bulkers and Star Bulk dropped 4%, Eagle Bulk and Golden Ocean 5%, and Diana 8%.

Click for more articles by Greg Miller

Related articles:

- Chaos theory: How tankers thrive amid energy crisis and war

- Zim flew higher in shipping boom, falls faster as market sinks

- US imports from China falling faster than from other countries

- Crude tanker owners see dollar signs as Russia ban draws near

- Shifting tides: The fall of container shipping stocks, the rise of tankers

- Shipping’s China syndrome: Demand sinks across multiple cargo markets

The post Shipping stocks in the crosshairs as China fears mount appeared first on FreightWaves.

Source: freightwaves - Shipping stocks in the crosshairs as China fears mount

Editor: Greg Miller