Freight News:

Pipes of trade tell the tale of manufacturing growth

When it comes to investing in trade’s “new tomorrow,” it’s a long game, and companies need to strategize on their return on investment in building infrastructure for that new opportunity.

When it comes to such investment scrutiny, the returns could take years. That’s why when I see companies in the maritime sector working to build infrastructure in a country, my antennae perk up. Why? It’s quite simple.

If a company is planning on spending millions to build a terminal or create distribution centers, it’s because it expects future growth. It is also a good forward-looking indicator of a country’s future gross domestic product because manufacturing and construction create jobs. Trade is essential to building a country’s middle class; expansion of the middle class is an energizer in global GDP.

India is the latest emerging country where you see more investment pouring in and additional companies expanding their manufacturing. Based on discussions with logistics leaders, they are happy with India Prime Minister Shri Narendra Modi’s push for infrastructure measures to both strengthen and expand India’s roads to support the flow of the transport of increased manufacturing. The changes we are seeing are a part of this long game. All countries need to start somewhere. India may be a decade behind China, but getting in on the ground floor is key to capturing market share and returns.

Growth doesn’t happen overnight, but it does need to be nurtured. The early innings of this growth story provide a unique opportunity for logistics companies — large and small.

And while there are many headlines about India, you can’t forget about Vietnam. The diversion of manufacturing and the increase in investments by ocean carriers in that country are far outpacing China.

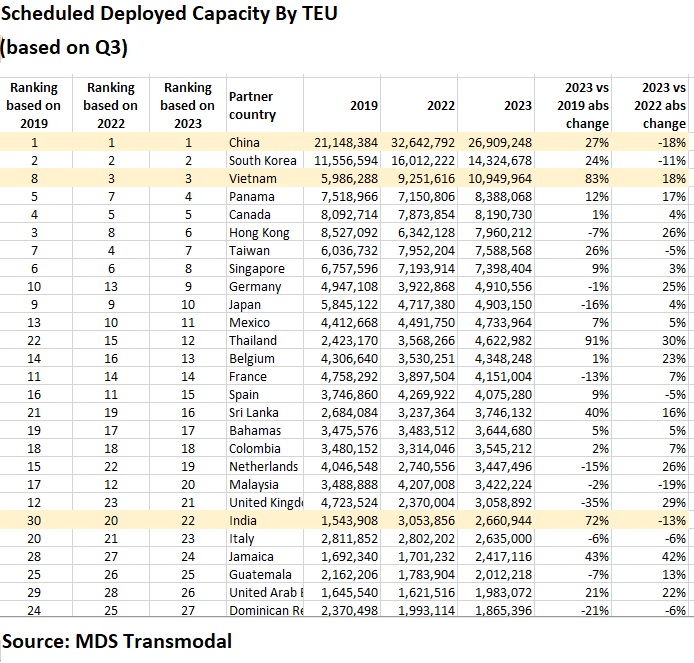

Containers don’t lie

According to data compiled by maritime transport data company MDS Transmodal, Vietnam’s deployed capacity by twenty-foot equivalent units has seen an explosive 83% jump when comparing 2023 to 2019. India has experienced a whopping 72% increase. China trails Vietnam with a 27% change. In a year-over-year comparison, China’s deployed capacity was down 18% in 2023 versus 2022; Vietnam was up 18%; and India was down 13%.

Antonella Teodoro, senior consultant at MDS Transmodal, said Vietnam seems to be leading the race to become the “brightest spot” behind China. The country is strengthened by the multisource production among the Asian countries that’s been seen in the last few years.

“Analyzing the latest trends in the capacity offered between the U.S. and its trading partners, our data suggests a significant increase in the capacity as well as in the number of liner services offered on the Vietnam-U.S. trade corridor,” Teodoro said. “In terms of capacity, Vietnam is now the third most important partner country for the U.S. — it was eighth place in 2019. Looking at the number of services, the change in the ranking is even more profound: 23rd in 2019, now sixth.”

An example of this logistics long game is the world’s largest ocean carrier, MSC. In 2022, MSC-owned Terminal Investment Ltd. signed an agreement with Ho Chi Minh City to build a $6 billion port in the Can Gio district, which is just outside of the city in Vietnam. This would be a transshipment “super port” and the first phase of construction is expected to begin in 2024. The terminal venture is a partnership with Vietnam National Shipping Lines and Saigon Port. Through it, MSC is looking to capture the expansion of trade.

In India, CMA CGM is bullish on the emerging market. Ceva Logistics, a French 3PL that is a unit of the company, acquired 96% of Stellar Value Chain Solutions in Mumbai. Rodolphe Saadé, chairman and CEO of the CMA CGM Group, has visited the country and Peter Levesque, CMA CGM North American president and CEO, is scheduled for a visit.

Ceva agreed to acquire 96% of Mumbai-based Stellar Value Chain Solutions from an affiliate of private equity firm Warburg Pincus and other shareholders.

Looking at the number of ocean string services, blank sailings have hit China the hardest. India has held the same number of services, according to MDS Transmodal data. Vietnam is down just one.

While shipping lines are showing interest in India with more services and capacity allocated on this trade corridor, comparing the numbers to 2019, the changes are less significant than compared to Vietnam. Looking ahead to 2024, Peter Sand, chief analyst at Oslo, Norway-based Xeneta, an ocean freight rate benchmarking and intelligence platform, said he expects higher export growth from Vietnam than India for 2024, calling the origins change in the China+1 a steady, slower burner. Also influencing the flow of trade in these areas is geopolitics.

“Vietnamese exports mainly to the U.S. will keep growing at a fast pace in 2024,” Sand said, “whereas India seems set to prove the point that they can turn out to become a solid go-to place if you need to de-risk your supply chains away from over-reliance on China or any other manufacturer in the Far East.”

The investments we are seeing today will only strengthen the world of trade for tomorrow.

Trade will always flow and the players in the logistics and supply chain are opportunistic. In order for trade to be successful, it must move. It is for this reason trade is agnostic and doesn’t play favorites.

China’s lockdowns, as well as the governmental pressures and geopolitical risks in recent years, have knocked the country off its pedestal of reliable cheap products. Other countries have jumped in and seized on this weakness.

We are in an exciting time of trade in which diversification of product offerings is key to a company’s success. This includes investing in trade’s new tomorrow.

The post Pipes of trade tell the tale of manufacturing growth appeared first on FreightWaves.

Source: freightwaves - Pipes of trade tell the tale of manufacturing growth

Editor: Lori Ann LaRocco