Freight News:

Pam Transportation’s Q1 earnings fall by half

Pam Transportation Services announced Monday after the market close that first-quarter earnings were roughly half the prior-year result.

The Tontitown, Arkansas-based truckload carrier reported adjusted net income of $12.7 million, or 57 cents per share. That compared to one analyst’s estimate of 42 cents per share and $1.18 a year ago. The adjusted number excluded $10 million, or 34 cents, in loss estimates for claims that are expected to settle above insurance policy limits.

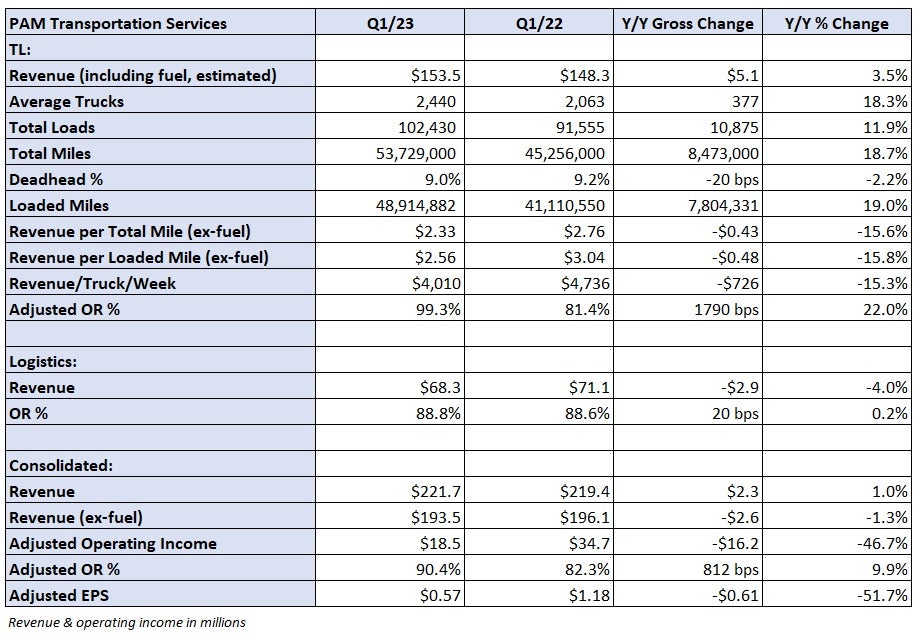

Pam’s (NASDAQ: PTSI) consolidated revenue was down 1% year over year (y/y) excluding fuel surcharges, to $194 million.

As the truckload market loosened and rates declined, so did the carrier’s TL metrics. Total TL revenue was 4% higher y/y, but average trucks in service increased by 18% primarily due to the June acquisition of Metropolitan Trucking.

Loaded miles were up 19%, but revenue per loaded mile (excluding fuel) was off 16% to $2.56.

The TL segment recorded a 99.3% operating ratio (the inverse of operating margin) and 92.8% excluding the $10 million loss, 1,140 basis points worse y/y. On a consolidated basis, salaries, wages and benefits, operating supplies, and insurance and claims expenses were up roughly 400 bps as a percentage of revenue.

The company’s logistics unit, which includes brokerage, reported a 4% decline in revenue to $68 million. The OR was basically flat y/y at 88.8%.

Pam ended the quarter with $194 million in cash, equity securities and availability on its revolver compared to outstanding debt of $251 million, a $13 million reduction since the close of 2022.

More FreightWaves articles by Todd Maiden

- Yellow, Teamsters to hash out operational changes by reopening NMFA early

- Schneider will be strategic carrier on CPKC north-south intermodal line

- Knight-Swift resets expectations for 2023 after rough Q1

Reefer rejection rates rebound, but remain low at 3.4%

videojs.getPlayer('1764065427376179334').ready(function() {

var myPlayer = this;

myPlayer.on("loadedmetadata", function() {

var browser_language, track_language, audioTracks;

browser_language = navigator.language || navigator.userLanguage; // IE <= 10

browser_language = browser_language.substr(0, 2);

audioTracks = myPlayer.audioTracks();

for (var i = 0; i < audioTracks.length; i++) {

track_language = audioTracks[i].language.substr(0, 2);

if (track_language) {

if (track_language === browser_language) {

audioTracks[i].enabled = true;

}

}

}

});

});

The post Pam Transportation’s Q1 earnings fall by half appeared first on FreightWaves.

Source: freightwaves - Pam Transportation’s Q1 earnings fall by half

Editor: Todd Maiden