Loaded and Rolling: The problem with load boards and small carrier exodus

The problem with load boards

Load board fraud is gaining attention after The Wall Street Journal reported Truckstop, a leading load board provider, found reports of fraud increased 400% from Q4 2021 to Q4 2022, the highest level since 2004, when it began tracking the data. This article prompted Craig Fuller, CEO and founder of FreightWaves, to write an article on Tuesday arguing for massive load board providers to take greater responsibility for instances of fraud that take place on their platforms.

Fuller wrote, “Load boards work more like Craigslist than Amazon in that the load board will list potential jobs for truckers, but the transaction is executed outside the load board platform, often through email or on the phone.” The challenge for load boards, brokers and carriers is making sure those that are offering services are actually legitimate. Currently there are legions of internal carrier compliance representatives at brokerages and FreightTech companies trying to identify and exclude hordes of double-brokering schemes that use fake motor carrier numbers or resell the booked load to another carrier for profit.

By the numbers, double-brokering schemes are costly and their extent staggering. The Wall Street Journal said, “Carrier-payments platform TriumphPay, a division of Dallas-based TBK Bank SSB, estimates at least $500 million to $700 million of shippers’ and brokers’ freight payments are going to double brokers annually.” Many of these companies that commit fraud are overseas using brokerage call centers or email phishing tactics to defraud carriers, brokers and shippers for payment through fraudulent invoicing. For large load boards, a new challenge is tackling the growing frustration among their users, paid or free, that are often using their third-party platforms and potentially paying for the right to be defrauded by malicious actors.

Small carrier exodus: Net revocations of authority surge

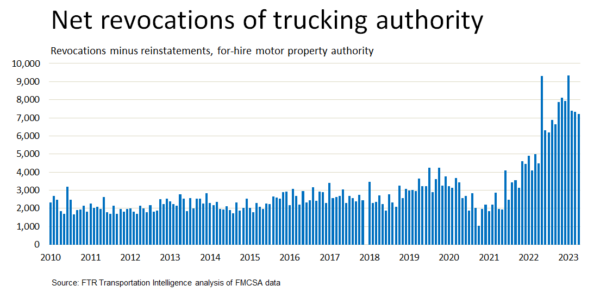

A recent article by Fleet Owner using data from FTR Transportation Intelligence reported that the number of carriers giving up their operating authorities and leaving the market resembles an exodus. A carrier typically gives up its authority if it goes out of business, is acquired by another carrier or joins an existing carrier as a company driver or owner-operator. While these revocation numbers look staggering, the article noted there are many more months to go before the pandemic glut of trucking capacity becomes lean enough to stop the downward slide of spot market rates.

Breaking down the numbers, Avery Vise at FTR saw 31,000 fleets give up operating authorities between January and April, and of that, 24,806 were one-truck operations. Owner-operators were not the only ones impacted. Vise said during that same four-month period, 42 carriers with 100 tractors or more gave up their authorities. From January to April 2022, that number was only seven.

Since last year, FreightWaves has frequently reported that low rates are causing a trucking bloodbath as rates are below carriers’ operating costs. Vise said net revocations could have been worse. “I believe that, had we not seen the steady relief in diesel prices that we’ve seen since they reached a record in June of last year, the level of failures actually would have been substantially higher,” he wrote, adding, “That almost unbroken period of fuel-price drops has helped soften the blow of lower spot rates, but the decline in spot rates is a bigger factor.”

Market update: April Cass data shows shipments and costs decline further

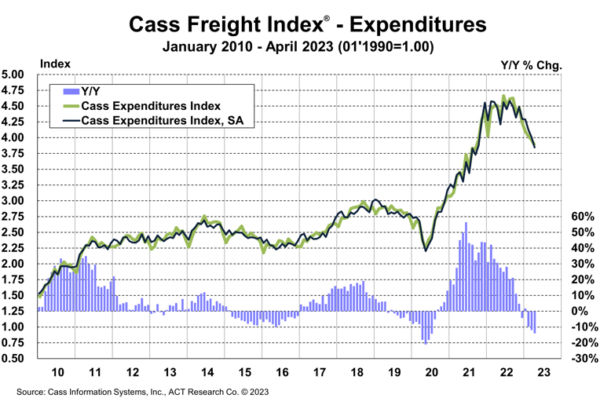

Shipments and freight expenditures data for April continue to point downward, according to recent data from freight payment processor Cass Information Systems. The freight index shipments data fell 2.4% year over year (y/y) in April as an extended soft patch and warmer weather pulled freight into January/February that would normally be tendered in March/April. The report noted that in spite of the April soft patch, higher frequency freight data series showed improvements through late April and into May, which suggests some seasonal improvements but freight tendering will still be lower than during the inventory building from last year.

Declining real retail shipments and restocking continue to be headwinds impacting freight volumes, but the report suggests that real income improvement and destocking may be points of optimism. Freight index expenditures, which measure total freight spend, fell 21.% month over month and 14% y/y in April as fuel and truckload rates continue to deteriorate in the face of a truckload capacity glut.

FreightWaves SONAR spotlight: Diesel prices continue gradual decline

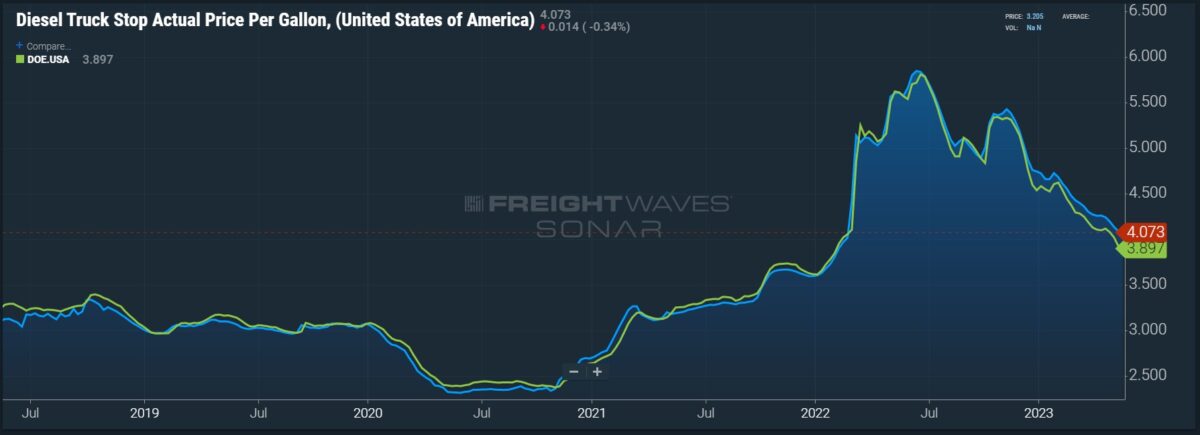

Summary: The benchmark price paid at diesel pumps reported by the Department of Energy/Energy Information Administration continued to fall this week, declining 2.5 cents per gallon from the previous week to settle at $3.897 per gallon. This is the 14th time in the past 15 weeks that reported prices declined.

Regarding demand, spot market prices are rising due to tighter diesel inventories, with agricultural activity appearing to be a factor. FreightWaves’ John Kinsgston wrote, “There have been numerous reports of particularly strong demand for diesel from the agricultural market; it was mentioned more than once on the recent earnings calls of various refining companies. That sort of demand appears to be showing up in the differentials for Chicago and Group 3, where diesel often feeds agricultural markets.”

Another factor impacting future diesel inventory levels relates to higher gasoline refining margins. Kingston noted that “gasoline refining margins have been running particularly strong, and some of those same refining executives on the earnings calls said their plants would likely be running ‘max gasoline’ output.” A question that remains is how far diesel will fall and what impact this will have on existing truckload capacity that is struggling financially in the face of lower freight rates.

The Routing Guide: Links from around the web

Survey finds 28% considered leaving trucking jobs in past year (Truck News)

After last year’s inventory tidal wave, where do retailers go from here? (Supply Chain Dive)

An unusually terrible freight market may get a lot worse (FreightWaves)

Reality of ocean container volume far cry from China reopening hype (FreightWaves)

AI isn’t new to the supply chain, but ChatGPT is expanding its role (FreightWaves)

Seasonal shift: Reefer fleets face deflated demand (Fleet Owner)

Like the content? Subscribe to the newsletter here.

The post Loaded and Rolling: The problem with load boards and small carrier exodus appeared first on FreightWaves.

Source: freightwaves - Loaded and Rolling: The problem with load boards and small carrier exodus

Editor: Thomas Wasson