Freight News:

Loaded and Rolling: Kearney supply chain report sees ‘Great Reset’; Loadsmith orders 800 autonomous trucks

Kearney supply chain report heralds ‘Great Reset’

Consulting firm Kearney recently released its 34th annual Council of Supply Chain Management Professionals (CSCMP) report, “State of Logistics 2023: The Great Reset.” A major theme of the report is the great rebalancing from the carrier-dominated market of the past two years to a shipper-focused one as freight volumes fell against a backdrop of higher truckload capacity. The report notes that total U.S. logistics costs rose 19.6% in 2022 to a record $2.3 trillion or 9.1% of U.S. gross domestic product.

Outlining the reset, the report argues, “After carriers made fortunes from the scarcities and bottlenecks of the pandemic era, the market has swung back sharply in shippers’ favor. Across all modes of transit, shipper demand and carrier capacity have rebalanced. Inventories are ample, and the quirky demand spikes of the quarantine era have leveled off for now.”

Rebalancing a freight network influenced by pandemic volatility is not an easy task. FreightWaves’ Mark Solomon wrote, “The report cautioned, however, that the optimal ways of achieving resilience are not always present. For example, an increasing fragmentation of demand means that massive distribution center footprints are becoming less profitable. Yet shippers often need a large footprint to ensure high levels of service and sufficient inventory levels.”

Loadsmith orders 800 Kodiak Robotics autonomous trucks

On Thursday, freight broker Loadsmith announced a deal with autonomous driver systems maker Kodiak Robotics for 800 trucks, with deliveries expected by the second half of 2025. Loadsmith seeks to expand its capacity-as-a-service offerings, which will use autonomous trucks moving interstate shipments between hubs. The initial focus for the driverless routes will be in Southwestern states where climate and distances are favorable testing grounds.

Fleet utilization is a driving force behind the decision. FreightWaves’ Alan Adler writes, “[Loadsmith CEO Brett] Suma counts on 2.5 times greater utilization than with a human-driven truck. With 6,000 trailers at a 3-to-1 trailer-to-tractor ratio, Loadsmith would need 2,000 human-driven trucks. With Kodiak Driver-equipped trucks, it’s just 800.”

This order follows a deal last November in which Loadsmith contracted with Wabash to purchase 6,000 trailers to expand its trailer-as-a-service offering. To power this capacity as a service network, Loadsmith partnered with Mastery Logistics last May to provide a TMS to power the autonomous truck network through the Mastermind transportation management system.

Market update: ACT For-Hire Trucking Index May data: Improving volumes, low rates

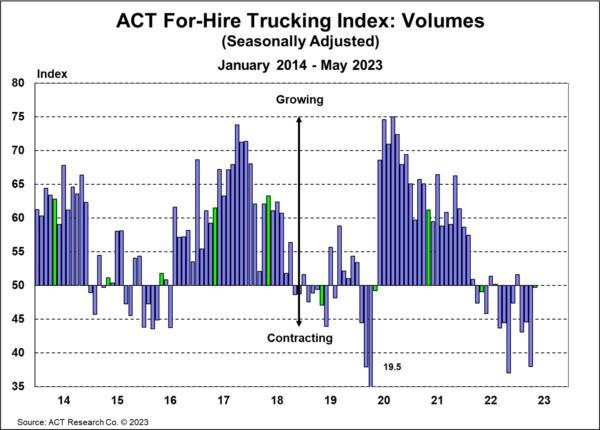

On Wednesday, ACT Research released May data for its For-Hire Trucking Index, noting improvements in freight volumes but persistent low prices. The volume index rose from 37.7 points in April to 49.4 points in May seasonally adjusted, with destocking peaking in March as one factor for improving conditions. For the indexes, any value over 50 indicates expansion, while below 50 is a contraction. The report suggests that the worst may be behind us in terms of the freight cycle bottom, stating, “The Volume Index has been below 50 for 12 of the past 13 months. If this cycle is like the last two, demand growth will return in 2024, perhaps even sooner.”

The Pricing index remains in contraction territory but rose 5.1 index points from 33.2 in April to 38.3 in May, as trucking conditions for carriers remain “brutal,” as described by one respondent. Further improvements in pricing are predicted, with the report adding, “While the pricing pendulum remains with shippers for now, the next capacity rebalancing has begun. With capacity slowing and set to decline later this year, rate trends should begin to recover as soon as traction on freight volumes is established.”

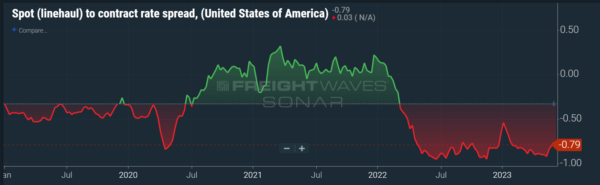

FreightWaves SONAR spotlight: Spot to contract rate spread favors committed freight

Summary: The spread between spot market linehaul rates and initial contract rate data remains elevated following a slight increase in contracted rates to 79 cents per mile in favor of contracted freight volumes. Van contracted initial base rate per mile follows a 14-day delay, with contracted rates increasing week over week from $2.39 per mile on May 30 to $2.43 per mile on June 6. Further contract rate degradation is expected as shippers complete bids for the second half of 2023 and push for greater rate concessions. Historically, a normal range for contract to spot rate spreads is 30 to 50 cents per mile.

Truckload carriers continue to limit spot market exposure and solicit additional and existing customers as they seek to fill freight volume gaps in their internal truckload network. Inventory levels among truckload carriers’ customer portfolios remain mixed as changing consumer demand and higher inflation curb spending. For smaller carriers and owner-operators who lack access to contacted loads, the lower spot market rates continue to negatively impact margins. For shippers who paid higher rates in the past two years, this market of loose truckload capacity and higher contracted rates provides greater leverage to push for higher tender compliance and service levels, as there are many carriers lower in the routing guide seeking opportunities for more volume if their incumbent carrier fails to execute.

The Routing Guide: Links from around the web

FreightWaves spotlights top shippers in 2023 Shipper of Choice awards (FreightWaves)

Slowdown in grocery inflation may be good news for trucking companies (FreightWaves)

Trucking group: Study supports greater use of hair tests for drivers (FreightWaves)

Are your employees using one of the 10 worst passwords in transportation? (Commercial Carrier Journal)

PalletTrader reaches 1 million transactions milestone, expands service (FreightWaves)

FMCSA issues final guidance to expose illegal brokers (FreightWaves)

Like the content? Subscribe to the newsletter here.

The post Loaded and Rolling: Kearney supply chain report sees ‘Great Reset’; Loadsmith orders 800 autonomous trucks appeared first on FreightWaves.

Source: freightwaves - Loaded and Rolling: Kearney supply chain report sees ‘Great Reset’; Loadsmith orders 800 autonomous trucks

Editor: Thomas Wasson