Freight News:

Loaded and Rolling: Freight market downturn turns 1 year old

Freight market downturn turns 1 year old

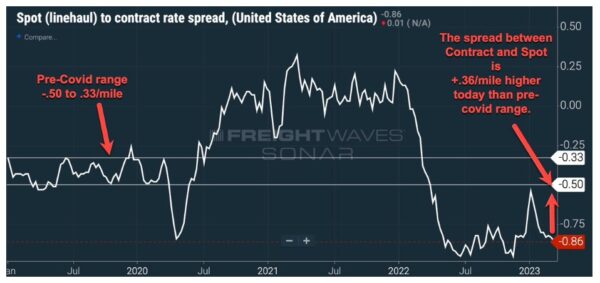

It has been just over a year since Craig Fuller, CEO and founder of FreightWaves, wrote an article titled “Why I believe a freight recession is imminent,” published March 31, 2022, in which he predicted the U.S. trucking market was heading toward a significant downturn.

Fuller noted the reaction in a follow-up article published Monday: “At first, there was a great deal of vitriol aimed at the FreightWaves analysis and also disagreement about the health of the freight market. This was most pronounced coming from asset-based truckload carriers that predominantly operate in the contract market. The downturn, they believed, was a spot market phenomenon that wouldn’t impact them.”

Fuller said part of this reasoning was many were contesting SONAR data due to relying on lagging indicators and government data. Those asset-based carriers often are running primarily contracted freight and, from my personal operational experience, are unable to quickly react when leading indicators like spot market rates plummet and the freight cycle changes. Spot market movements frequently steer contract rates and failure to smell the smoke leads to uncomfortable surprises when the forest is on fire for a carrier’s book of business.

Summarizing the current market conditions, Fuller wrote, “Hindsight is 20/20, and now the debate over the freight market downturn is a thing of the past. The freight recession has come, and carriers, regardless of whether they operate in the contract or spot markets, are having to contend with it. “

Warehousing: What you need to know with Joe Oliaro

FreightWaves interviewed Joe Oliario, VP of sales and chief real estate officer at Wagner Logistics, on Tuesday about the warehousing shortage, its impact on trucking and what onshoring will bring in the near future for the industrial facility market.

Oliaro outlined the current challenges with warehouse capacity rates hovering around 95% and explained how in spite of record demand, there are challenges involved with selecting, building and managing a site when looking to expand one’s warehousing footprint. One major challenge involves labor and Oliaro highlighted growing technology trends from automation to exo-suits to help workers prevent injuries.

Nearshoring and company growth is another major topic highlighted, with Oliaro predicting increased activity in the center part of the country, as warehousing space and expansion potential remains constricted at major logistics hubs like the Los Angeles and New Jersey port areas. Part of this involves zoning in addition to availability of space to build or expand existing facilities.

You can view the entire interview here.

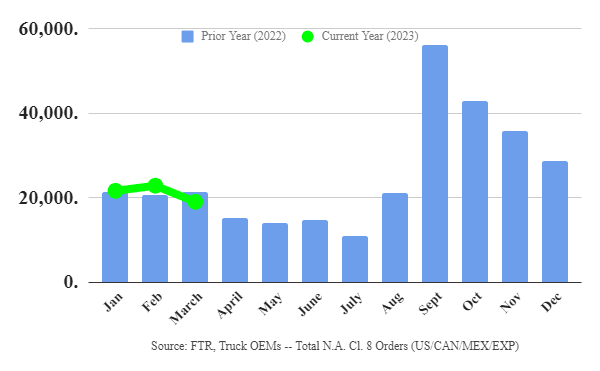

Market Update: FTR March Class 8 orders return to seasonality

In a report released Tuesday by FTR Transportation Intelligence, preliminary Class 8 orders fell in March for the fifth time in the past six months to 19,000 units. The reported decline was 18% month over month and 11% year over year. Regarding reasons for the declines, the report noted a return to seasonal buying trends. The report anticipates reduced order levels continuing throughout summer but that fleet quoting activity and requests for equipment are in line with past seasonal behaviors.

Eric Starks, chairman of the board at FTR, said in the report: “With build activity over the last several months hovering near 27,000 units, backlogs likely fell during the month. Given that backlogs are sitting at such high levels, however, it is difficult to ascertain if there is a fundamental weakening in the Class 8 equipment market given order activity levels.”

FreightWaves’ Alan Adler noted this data is in line with another transportation intelligence firm’s numbers, writing, “ACT Research pegged March orders slightly higher at 19,200.” The current consensus is that in spite of Class 8 orders slowing down, the ongoing orders backlog will keep OEMs busy.

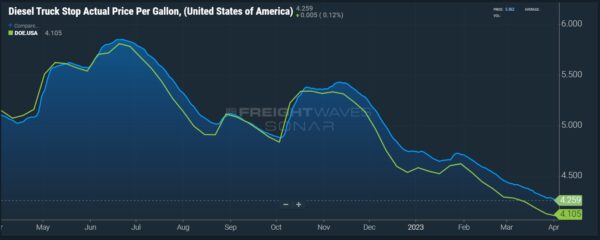

FreightWaves SONAR spotlight: DOE benchmark falls in spite of OPEC+ output cut

Summary: The Department of Energy/Energy Information Administration average weekly diesel price fell for a ninth consecutive week, falling 2.3 cents to settle at $4.105 a gallon. The DOE/EIA benchmark is frequently used to calculate fuel surcharges. For carriers that lack a fuel surcharge with customers or frequently use the spot market, falling diesel prices over the last few weeks are welcome relief, as fuel prices can contribute between 40 cents and 43 cents per mile, depending on region and equipment, according to the most recent American Transportation Research Institute operational costs data. Anecdotally, this cost can rise as high as 65 cents to 85 cents per mile for some smaller carriers and owner-operators.

In spite of the decline, there are growing concerns that diesel prices will increase in the coming weeks based on recent movements by OPEC. FreightWaves’ John Kingston wrote: “But on the same day the [DOE/EIA] decline was posted, futures prices across the oil complex soared on the unexpected news over the weekend that the OPEC+ group, which includes OPEC and a group of non-OPEC oil exporters led by Russia, had agreed to cut output by 1 million barrels a day. The reductions are to go into effect in May and last through the year.”

One possible deflationary pressure on diesel prices would be a recession in trucking or the overall macroeconomic environment. Kingston added: “Diesel prices have lagged Brent as there is growing concern about a recession that could hit demand. As an industrial fuel, diesel is often hit harder by a slowdown than gasoline. Weak trucking markets are potentially contributing to the decline in diesel prices, and that weakness is showing up in demand figures.”

The Routing Guide: Links from around the web

Lawmakers aim to train more truck drivers, ease supply chain issues through bipartisan bill (CNBC)

Walmart’s first in-house driver app becomes their highest rated tech tool yet (Commercial Carrier Journal)

Owner-ops sound off to FMCSA on need for more light on brokered rates (OverDrive)

FMCSA provides updates to driver compensation, detention time studies at MATS (Fleet Owner)

California gets EPA waiver to move ahead with Advanced Clean Trucks rule (FreightWaves)

US Xpress HQ slated to remain following Knight-Swift deal (Transport Dive)

Like the content? Subscribe to the newsletter here.

The post Loaded and Rolling: Freight market downturn turns 1 year old appeared first on FreightWaves.

Source: freightwaves - Loaded and Rolling: Freight market downturn turns 1 year old

Editor: Thomas Wasson