How safe is Red Sea? Different shipping lines have different answers

The security situation in the Red Sea continues to drive shipping stock prices both up and down. Longer voyage distances due to detours around the Cape of Good Hope reduce effective capacity, a positive for freight rates, and thus share pricing. Conversely, if fewer ships divert, fleet capacity is preserved and stocks fall.

The bullish stock thesis going into the Christmas break was that all container lines would continue to divert vessels due to concerns over crew safety, regardless of Operation Prosperity Guardian (OPG), a U.S.-led military effort to patrol the Red Sea.

That thesis turned out to be wrong. Different container lines are now assessing the Red Sea risk differently. Some lines are planning to resume transits through the Bab-el-Mandeb Strait off Yemen.

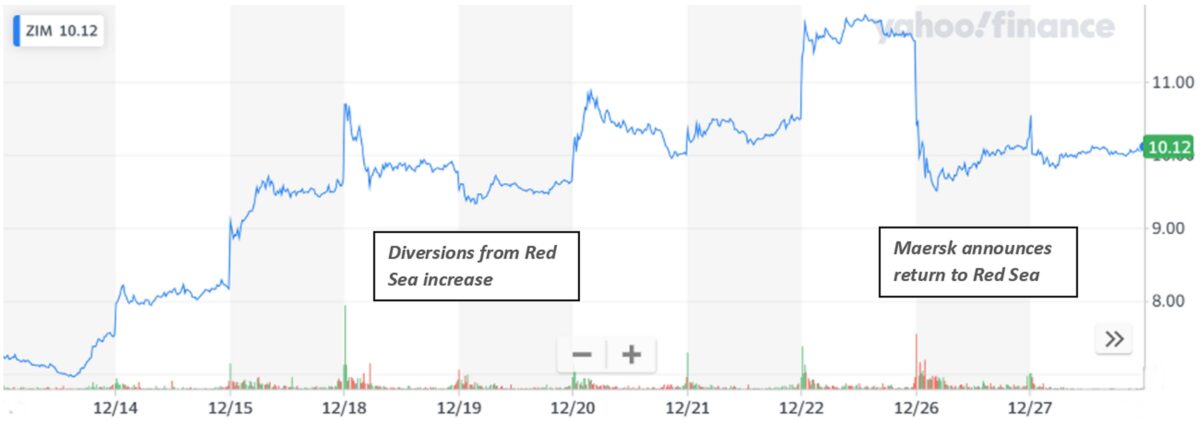

The effect of this change is most visible in share-price gyrations of Israeli container line Zim (NYSE: ZIM), a company whose earnings are highly leveraged to spot rates.

Zim’s stock price surged 60% between Dec. 13 and Friday as Red Sea diversions increased, then plunged as much as 18% in mid-day trading on Tuesday following news of fewer detours by ocean carrier Maersk. Tuesday’s trading in Zim’s stock was more than quadruple average volumes.

Other shipping equities, including both container and tanker stocks, also pulled back on Tuesday and Wednesday, presumably pricing in a less extreme view on future detours.

Maersk and CMA CGM headed back to Red Sea

At least two carriers plan to resume Red Sea transits despite intensified missile and drone launches — including an attack on the container ship MSC United VIII on Tuesday — and a new agreement on bonuses and compensation for seafarers due to the “exceptional” risk they face.

“With the OPG initiative in operation, we are preparing to allow for vessels to resume transit through the Red Sea both eastbound and westbound … as soon as operationally possible,” said Danish carrier Maersk on Sunday.

French carrier CMA CGM said Tuesday, “We are currently devising plans for the gradual increase in the number of vessels transiting through the Suez Canal.”

FreightWaves asked Maersk if it had reassessed its decision to return to the Red Sea in light of Tuesday’s attack on MSC United VIII. It has not.

“We continue to prepare our vessels for passage through the Red Sea,” a Maersk spokesperson told FreightWaves on Wednesday.

However, he conceded that “the overall risk in the area is not eliminated completely,” and said “Maersk will not hesitate to re-evaluate the situation and once again initiate diversion plans if we deem it necessary for the safety of our seafarers.”

MSC and Hapag-Lloyd will continue Red Sea detours

In contrast to Maersk and CMA CGM, Germany’s Hapag-Lloyd and Switzerland’s MSC will continue to divert from the Red Sea.

“The situation remains too dangerous to cross the Suez Canal and therefore we will maintain our diversion around the Cape of Good Hope,” said Hapag-Lloyd on Wednesday.

MSC said Tuesday that it “will continue to reroute vessels booked for Suez transits via the Cape of Good Hope.”

At least some MSC ships have continued to transit, however. The MSC United VIII was en route from Saudi Arabia to Pakistan when it was attacked.

Details on the incident are limited. U.S. Central Command (CENTCOM) said no commercial vessels were hit on Tuesday.

However, MSC said that “a thorough assessment of the vessel is being conducted,” which raises the question: If it was not hit by anything, why would it be assessed? FreightWaves sent multiple requests for a clarification to MSC; it has yet to respond.

Barrage of drones and missiles from Yemen

Operation Prosperity Guardian had a particularly busy day on Tuesday.

According to CENTCOM, the destroyer U.S.S. Laboon and Hornet jets launched from the aircraft carrier U.S.S. Dwight D. Eisenhower intercepted and destroyed 12 suicide drones, three antiballistic missiles and two cruise missiles fired by Yemen’s Houthi rebels during a 10-hour barrage.

The action continued on Wednesday: UK Maritime Trade Operations (UKMTO) reported a missile sighting, an explosion, and two additional incidents.

Meanwhile, newly enacted compensation rules highlight the ongoing danger to seafarers even as more container ships plan to run the gauntlet through the Bab-el-Mandeb Strait.

The International Bargaining Forum (IBF) agreed on Friday to designate the southern Red Sea and Bab-el-Mandeb Strait as a high-risk area. Seafarers whose contracts are covered by IBF agreements will receive a bonus equal to their basic wage for the duration of the transit and double compensation in the case of death or disability.

The IBF decision also requires transiting ships to enact mandatory security arrangements equivalent to International Ship and Port Facility Security Code (ISPS) Level 3. ISPS Level 3 is reserved for an “exceptional” threat in which “a security incident is probable or imminent.”

Click for more articles by Greg Miller

Related articles:

- US-led forces in Red Sea will be defensive ‘highway patrol’

- Red Sea fallout much greater for containers than tankers, bulkers

- Red Sea chaos should boost tanker and container shipping rates

- Why attacks on container ships caused container stocks to jump

- Zim container ships divert as threat to Israel-linked vessels mounts

- Yet another shipping ‘chokepoint’ risk as Yemen rebels attack

- War in Israel: The new geopolitical flashpoint for ocean shipping

The post How safe is Red Sea? Different shipping lines have different answers appeared first on FreightWaves.

Source: freightwaves - How safe is Red Sea? Different shipping lines have different answers

Editor: Greg Miller