Freight News:

For diesel consumers, a day with lots of discouraging news

If you’re a diesel consumer, Tuesday could fairly be described as a terrible, horrible, no good, very bad day.

The only development in the market that slightly mitigated the negativity was the fact that the Department of Energy/Energy Information Administration weekly average retail diesel price rose by just a small amount, to $4.492 a gallon — an increase of 1.7 cents. It’s the eighth time in the past nine weeks that the price rose; the other time it was unchanged.

During those nine weeks, the price has risen 72.6 cents a gallon. It’s at the highest level since the Feb. 6 mark of $4.539 a gallon.

The weekly price was released a day late due to the Labor Day holiday.

But even Tuesday’s moderate increase reflects a national average, and regional prices in some cases have risen a lot more. That is a problem for fleets that set their fuel surcharges to the national price but pay local prices out on the road.

For example, the DOE/EIA average price in the Rocky Mountains rose 6.9 cents a gallon. Prices in New England climbed 3.4 cents a gallon.

The California average price, which is always well over $1 more than the national average, climbed even further, an increase of 12.3 cents. However, fuel surcharges in California generally are not tied to the national average.

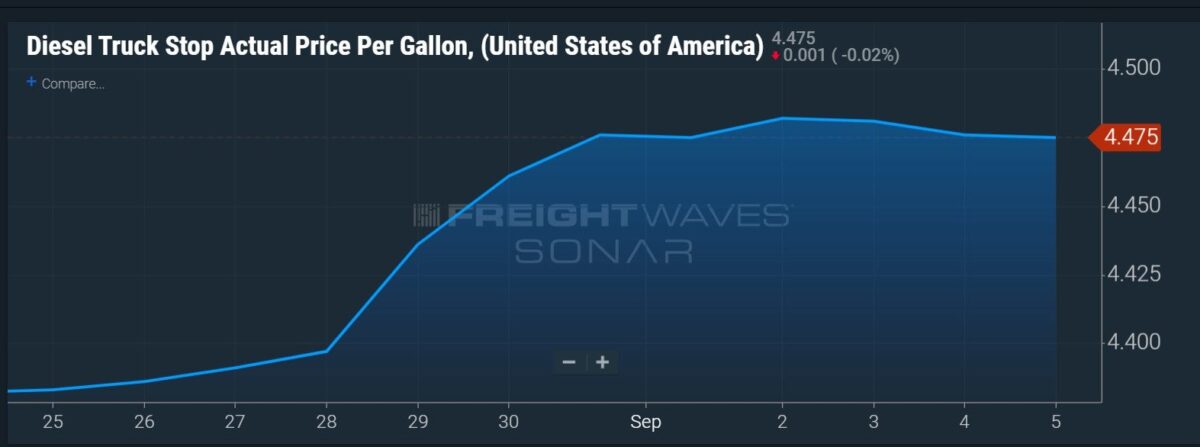

Additionally, the relatively muted increase stands in sharp contrast to the average daily price in the DTS.USA data series in FreightWaves’ SONAR and also to some granular data made available by Pilot Flying J.

That leading travel center chain posts a downloadable spreadsheet of its retail prices for its more than 700 outlets nationwide. Data between Aug. 30 and Wednesday — not the exact time spread surveyed by EIA but with a great deal of overlap — shows some significantly higher increases but some places where the price at the pump didn’t rise at all and some where it fell.

That data is showing the wide range of retail price changes going on in a market where futures prices for ultra low sulfur diesel on the CME commodity exchange have swung wildly just since mid-August.

ULSD settled Aug. 15 at $3.028 a gallon. By Aug. 25, it settled at $3.3075, then dropped to $3.1095 last Friday before popping back up Tuesday to $3.2196.

The volatility continued Wednesday. After an 11.46-cents-per-gallon increase Tuesday, the ULSD settlement Wednesday was $3.1927 a gallon, down 2.69 cents. But the swing between low and high over the day was almost 10 cents a gallon.

And at the retail pumps at Pilot, that sort of volatility was playing out. The average increase between Aug. 30 and Wednesday, according to FreightWaves’ review of the data in the spreadsheet, was about 2.4 cents a gallon, not much higher than the 1.7-cents-per-gallon increase posted by DOE/EIA.

But look at the individual station data, and there are many increases during that time of 10 to 15 cents per gallon and some as much as 34 cents a gallon. That can significantly limit any correlation between the DOE/EIA price used for fuel surcharges and the actual price some truckers are paying at certain outlets.

The other news Tuesday in the terrible, horrible, no good, very bad day for diesel included the following developments:

- In an interview with Bloomberg at the S&P Global APPEC week conference in Singapore, the largest oil-focused event in Asia, Frederick Lasserre, the global head of research and analysis at major trading house Gunvor Group, said refining capacity worldwide is tight and “there’s no plan B.” Lasserre said refiners have postponed maintenance and that technical problems could develop as a result. “The market is overly sensitive to any unexpected supply disruption anywhere,” Bloomberg quoted Lasserre as saying. “We have no stocks, and we have no excess capacity anywhere.”

- Bloomberg also reported that Russian product exports fell to an 11-month low in August. That data includes diesel exports, of which Russia is a major world supplier. The decline for diesel and gasoil — a diesel-similar middle distillate product — dropped 5.7% between July and August, Bloomberg said, citing data it compiled with Vortexa Ltd., an analytics company.

- Saudi Arabia will continue its production cutback of 1 million barrels a day (b/d) right through the end of 2023, the Saudi Press Agency said on Tuesday. That means Saudi Arabia will hold its output at about 9 million b/d. In April, according to data from SP Global Commodity Insights, Saudi Arabia produced 10.5 million barrels a day. That was just before the implementation of a broad OPEC+ agreement on cutbacks by its 23 member states, which the Saudis then added to with its own 1 million-barrel-a-day reduction that now carries through the rest of the year.

- A Wall Street Journal article on diesel prices noted that the cutbacks of Saudi grades are particularly hitting that part of the barrel because Saudi crude has an especially strong diesel yield when put through a refinery. “Diesel is more heavily affected because of the type of crude that’s being taken out of the market,” Alan Gelder, vice president for refining, chemicals and oil markets in Wood Mackenzie’s commodities research business, was quoted as saying. “Saudi’s oil provides a higher yield for diesel than lighter crude oils. This loss adds further cost to the economy.”

More articles by John Kingston

IEA spells out supply and demand imbalance driving oil prices higher

Werner hit with more than $36 million jury award in its failure to hire deaf driver applicant

Sentencing in Louisiana staged truck accident case is now a December doubleheader

The post For diesel consumers, a day with lots of discouraging news appeared first on FreightWaves.

Source: freightwaves - For diesel consumers, a day with lots of discouraging news

Editor: John Kingston