Freight News:

Electric trucks should shake off setbacks in 2024

Meaningful volume growth eluded heavy-duty electric trucks last year for several reasons: Charging infrastructure lagged; recalls for battery fires delayed getting many trucks on the road; and money problems imperiled two battery makers.

The news wasn’t all bad, however. Real estate developers invested in and began building electric charging depots. Single-charge driving range improved for early Class 8 electric offerings from two legacy OEMs. A battery-making startup focused on lithium-iron phosphate chemistry achieved more than 600 miles on a single charge, albeit in a passenger vehicle.

Despite the ongoing challenge of matching electric trucks with convenient and reliable charging, 2024 looks like it could shake off some of the growing pains of 2023.

Next-generation electric trucks promise greater range

Legacy truck makers will bring next-generation battery-electric trucks to the U.S. after European debuts this year. They have financial heft and engineering might from global operations,

Among the most promising are the eActros 600 from Mercedes-Benz Trucks, expected to offer 310 miles on a single charge. A conventionally styled Freightliner eCascadia will follow production for the second-generation eCascadia. Single-charge driving range improved from 150 miles to 230 miles.

Volvo Trucks North America advertises a range of 275 miles for the VNR Electric with six battery packs instead of four.

Peterbilt and Kenworth will benefit from a new DAF Trucks entry in Europe offering 310 miles on a single charge. That’s more than double the current range of the Peterbilt Model 579EV and the Kenworth T680E. They were among the earliest electric models offered for sale in the U.S.

Tesla Semi takes long-range electric truck lead

The long-delayed Tesla Semi began limited production in 2023. It boasts a range of up to 500 miles between charging because it takes on electricity at 750 kilowatt hours. That’s nearly three times the rate of other electric trucks. One Semi covered 1,000 miles in a single workday in September. Tesla CEO Elon Musk’s prediction of 50,000 Semis being produced this year appears the stretchiest of stretch goals.

The North American Council for Freight Efficiency Run on Less Electric Depot studied 10 electric depots and their charging capabilities. It confirmed Tesla’s current charging efficiency dominance among heavy-duty trucks.

The Hyliion Hypertruck ERX natural gas-electric powertrain shown in Peterbilt Model 579 gliders disappeared from view late in 2023. The startup’s board of directors saw no path to profitability. Suppliers raised costs. Serious interest from fleets lacked for a more complex solution to zero-emission driving than a straight battery-electric.

Hyliion pivoted to using Karno generator technology purchased from GE for stationary electric generation. It will be a story to watch in 2024. A recent test using untreated natural gas directly from the Permian Basin showed the generator could achieve heat levels need to generate electricity with an ultra-low emissions profile.

Incentive picture for electric trucks begins to shift

California’s Hybrid and Zero-Emission Truck and Bus Voucher Project (HVIP) provides tens of millions of dollars to help fleets manage the higher upfront cost of acquiring electric trucks. Large fleets have gobbled up much of the money so far. But this will be the last year most will be eligible to get up to $168,000 per Class 8 battery-electric truck.

For example, Schneider acquired 50 Freightliner eCascadias through California’s Joint Electric Truck Scaling Initiative. The company added 42 more eCascadias by the end of the year.

HVIP vouchers applied to 30 of them. Environmental Protection Agency funds helped on five. The Volkswagen Environmental Trust that resulted from the “Dieselgate” emissions-cheating scandal in 2015 partially paid for seven.

The 92 electric trucks are among the tops among carriers but represent less than 1% of Schneider’s 10,200 tractors. In November, the Green Bay, Wisconsin-based company celebrated 1 million miles of electric driving. That’s impressive until comparing it to the 9.8 million freight miles Schneider’s fleet amasses every day.

Doubling discounts for smaller fleets

Calstart administers HVIP for the California Air Resources Board. It is shifting the funds to smaller fleets and doubling the discounts available. That includes allowing vouchers to go to truck-as-a-service providers that bundle equipment, maintenance and electricity into a single monthly payment.

Large fleets might end up contracting some of their routes to these independent operators in lieu of buying outright. If the recently delayed Advanced Clean Fleets rule takes effect, fleets of 50 or more trucks will no longer qualify for HVIP incentives.

The exception is for companies that buy more than the required number of electric trucks. They would still qualify for HVIP vouchers for trucks beyond their required quota.

Ten states, including Maryland and Rhode Island in December, have adopted California’s Advanced Clean Truck rule. It requires manufacturers to make higher percentages of zero-emission trucks available over the next two decades.

The medium-duty electric truck picture

Expect to see more medium-duty electric trucks this year. For starters, there are imports by Daimler Truck of the Rizon Class 4-5 models and Freightliner’s scaling of the Class 6 eM2 for hub-and-spoke deliveries. An electric chassis for utility and other vocational uses also is in the works.

Medium-duty trucks charge on either direct current or alternating current, so-called Level 2 charging. Level 2 is easier to set up for set routes and return-to-base operations in which trucks charge overnight.

Mack Trucks added Mexico to its markets for its MD Class 6 and 7 electric truck. They will be built alongside diesel-power MD Series trucks in Roanoke, Virginia. Navistar is selling its MV Electric Class 6 and 7 trucks. Production is in the process of moving to San Antonio from Escobedo, Mexico.

In addition to the Mack MD Electric, Isuzu revealed its first all-electric production model, the Class 5 N-Series EV, and Hino showed the Class 5 M5e cabover and Class 6 L6e conventional medium-duty truck models during Work Truck Week in Indianapolis.

Workhorse Group began early production of its ground up W56 electric step van after abandoning its problem-plagued C-Series electric vans. The oft-troubled company persuaded shareholders to authorize new stock. And it grew its dealership network to eight, including outlets in Southern and Northern California.

The company’s flagging stock price — trading at 37 cents a share Tuesday — brought a delisting warning from the Nasdaq in September. The increased share authorization from 200 million to 450 million shares could allow a reverse stock split that would artificially raise the share price.

Infrastructure for electric trucks took major but inadequate strides in 2023

Some of the nation’s largest real estate developers, including Prologis and CBRE, and a host of well-funded startups took a shine to electric trucks in 2023. They bought up land and worked with utilities to get multiple megawatts of electricity delivered to electric truck depots.

Fruition of some of those plans will come closer in 2024, though combined they fall far short of the 157,000 truck charging points the California Energy Commission estimated in 2021 would be needed to support 180,000 medium- and heavy-duty electric trucks and buses anticipated by 2030.

Schneider and NFI Industries created their own charging depots for drayage trucks. Schneider is close to fully energizing a 4.8-megawatt facility in El Monte capable of charging 32 trucks at one time. Delays in receiving switchgear delayed NFI’s depot in Ontario, California, until sometime this year.

Startup WattEV opened a public truck charging depot at the Port of Long Beach with plans to open three more in California in Bakersfield, San Bernardino and Gardena.

Forum Mobility supplied Hight Logistics with four electric trucks and charging in Long Beach. It expects to energize a depot capable of charging 90 trucks at one time near the Port of Oakland this year.

The $650 million Greenlane charging infrastructure joint venture of Daimler Truck North America, NewEra Energy and BlackRock Climate Infrastructure hired a chief executive in 2023. It plans medium- and heavy-duty truck electric charging and hydrogen fueling locations on the East and West coasts and the Texas Triangle formed by Austin, Dallas, Houston and San Antonio and connected by Interstates 45, 10 and 35.

2 battery startups hit the wall in 2023

The high-voltage batteries key to electric trucks lost two startup players in 2023. Romeo Power was liquidated and its assets sold to Mullen Automotive following Nikola Corp.’s purchase of the struggling company in August 2022. Fires in Romeo battery packs led to an expensive recall and Nikola’s halt in making battery-electric vehicles — at least for the near term.

Volvo Trucks North America also recalled heavy-duty electric trucks because of the possibility of battery fires.

they await replacement batteries. (Photo from YouTube video by Steve Dutcher)

Financially struggling Proterra Inc. entered Chapter 11 bankruptcy reorganization in August. Volvo Group paid $210 million to buy its battery business in November. Proterra supplies Volvo rival Daimler Truck North America’s Freightliner Custom Chassis and Thomas Built Buses as well as Nikola’s hydrogen-powered fuel cell electric truck.

An exception was Our Next Energy (ONE), a Michigan startup supplying lithium-iron phosphate batteries to medium-duty truck makers Motiv Power Systems and the Shyft Group. ONE’s focus on increasing driving range reached 608 miles on a single charge in a BMW iX SUV using a dual-chemistry battery.

Hydrogen-powered fuel cells trucks gain acceptance

The number of hydrogen-powered fuel cell electric trucks sold can still be counted on fingers and toes. But that number should grow in 2024 as Nikola scales its Tre FCEV aimed at California, where a nascent hydrogen infrastructure exists.

Nikola became a customer of FirstElement Fuel’s hydrogen fueling station near Oakland as part of a 10-year partnership. It is building enough Hyla-branded stations with partners like Voltera to fuel trucks it sells. Most of those will join the move toward drayage electrification, which carry HVIP incentives of up to $288,000 per truck.

Other green shoots:

- Hyzon Motors plans to make its 200kWh fuel cell available for heavy-duty trucks while looking for customers that want fuel cells for stationary uses.

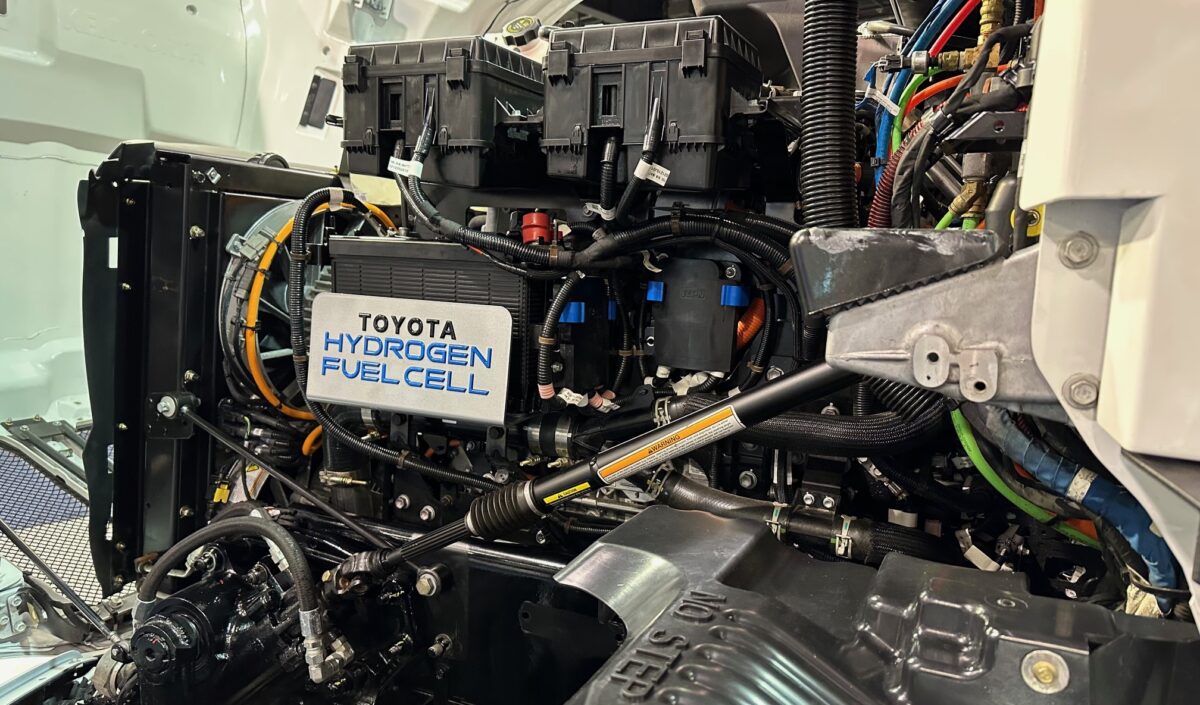

- Toyota is building heavy-duty fuel cells in Kentucky for Kenworth and Peterbilt for availability next year.

- DTNA continues working with Cummins Inc. on fuel cell retrofits for Freightliner Cascadias.

- Onshoring of fuel cells from the cellcentric joint venture between Daimler Truck and Volvo Group are a few years out, but Daimler is testing its GenH2 truck with European customers following a 647-mile run on a single fill-up in Germany in October.

Federal investment in hydrogen-making hubs could significantly cut the price of hydrogen fuel, but rules from the Biden administration requiring use of renewables like solar and wind power to make green electricity could slow progress.

Nonetheless, Plug Power installed a megawatt electrolyzer at an Amazon distribution center in Colorado to make hydrogen fuel for 225 fuel cell forklifts used there.

Related articles:

Hyliion spikes powertrain business and lays off 175 employees

Nikola asks customers to return electric trucks at risk of fires

Real estate investors surge into electric truck charging

Click for more FreightWaves articles by Alan Adler.

The post Electric trucks should shake off setbacks in 2024 appeared first on FreightWaves.

Source: freightwaves - Electric trucks should shake off setbacks in 2024

Editor: Alan Adler