Freight News:

ArcBest sees 20% increase in shipments at core accounts

Less-than-truckload carriers continue to report higher shipment counts following Yellow’s exit, but total tonnage is being constrained by lighter shipment weights.

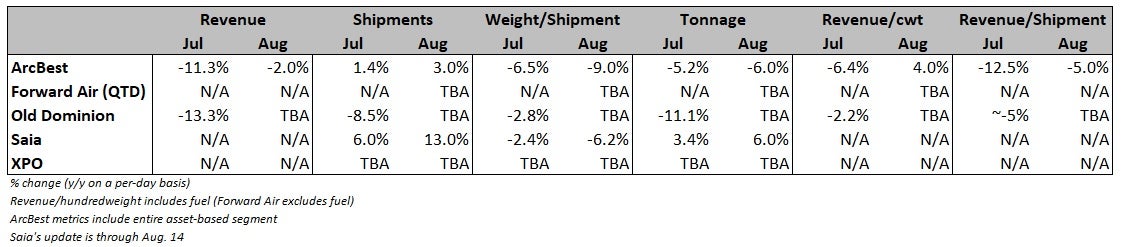

ArcBest (NASDAQ: ARCB) announced Monday that August shipments were 3% higher year over year (y/y), following a 1.4% increase in July. However, weight per shipment was off by mid- and high-single digits in both months, respectively. ArcBest’s tonnage was 5.2% lower y/y in July and is down 6% so far in August.

The company faced formidable tonnage comps to a year ago (up 7% and 8%, respectively) versus the rest of the industry, which had seen tonnage turn meaningfully negative by the end of last summer.

Its asset-based unit, which includes results from LTL carrier ABF Freight, had been using a dynamic pricing model that relies on noncontractual shipments with a less favorable pricing profile to keep the network full. As Yellow’s troubles mounted, ArcBest backed away from the strategy and began hauling more freight from its core customers that were also using Yellow. Shipments from core accounts are now 20% higher than they were in June at roughly 20,000 per day.

“Asset-Based network capacity has been re-allocated to serve the core business increase by raising prices to reduce shipments sourced from the Asset-Based tech-enabled dynamic LTL-rated, market-based pricing program,” the company’s filing with the Securities and Exchange Commission read. “The LTL marketplace is changing each day, and we are adapting and responding to achieve growth in our core business while maximizing profitability and continuing to serve customers with excellence.”

Carrier Saia (NASDAQ: SAIA) recently reported a 13% y/y increase in shipments through the first two weeks of August. Its tonnage was up 3.4% y/y in July and 6% higher in August. Weight per shipment was down 2.4% and 6.2% in both months, respectively.

A reduction of capacity in the marketplace is visible in recent yield trends.

ArcBest’s revenue per hundredweight, or yield, increased 4% y/y in August, following a 6.4% decline in July. The monthly changes were compared to growth rates of roughly 10% last year. The yield metric includes fuel surcharges. Diesel prices are down 21% y/y so far in the quarter but up 11% in August from July.

“The industry pricing environment continues to be rational and is improving because of the recent market changes,” the update stated. “The shift in ArcBest’s Asset-Based business mix, combined with improved yield management opportunities, has significantly improved Asset-Based yield metrics.”

Revenue per day in the asset-based segment was down just 2% y/y in August following an 11.3% decline in July and a 10% drop in the second quarter. Daily revenue is up 2% sequentially so far in the quarter. Yield is up 13% sequentially.

The company’s asset-based unit normally sees little change in operating ratio from the second to the third quarter each year. Even with 300 to 400 basis points in cost headwinds from the recent implementation of a new labor contract with its union employees, it expects modest improvement from the 92.8% adjusted OR recorded a quarter ago.

ArcBest said revenue in its asset-light division, which includes truck brokerage, was down roughly 20% y/y in the quarter as a slight increase in shipments was dragged lower by a high-20% decline in revenue per shipment. Purchased transportation expense as a percentage of revenue was also up between 300 and 400 bps y/y. The company’s forecast calls for the segment to see a $10 million to $15 million decline in adjusted operating income, implying an operating loss from the $6.4 million in income booked in the second quarter.

The filing said ArcBest will “remain focused on aligning costs with business levels” in the unit.

More FreightWaves articles by Todd Maiden

- Knight-Swift executives take pay cut amid cost reduction efforts

- Ascent Global Logistics lands new owner

- Forward Air’s latest deal spooks customers, investors

The post ArcBest sees 20% increase in shipments at core accounts appeared first on FreightWaves.

Source: freightwaves - ArcBest sees 20% increase in shipments at core accounts

Editor: Todd Maiden