Freight News:

Covenant buys poultry hauler and reports softer 1st quarter

Covenant Logistics used the occasion of its first-quarter earnings Thursday to disclose it had spent what could amount to more than $100 million to acquire an Arkansas trucking company primarily involved in poultry-related freight movement.

Lew Thompson & Son is based in Huntsville, Arkansas. In its prepared statement announcing the deal and the earnings, Covenant said it had purchased Thompson for approximately $100 million as well as an earnout that could bring the price up by another $30 million depending on performance.

Revenue at Lew Thompson in 2022 was approximately $64 million. Covenant (NASDAQ: CVLG) said it expects the acquisition to be “immediately accretive.”

The price paid by Covenant is about 5.2 times the estimated EBITDA of Lew Thompson. Covenant financed the purchase with about $45 million from its cash holdings and approximately $55 million from an asset-based lending credit facility.

Following the deal, Covenant said it expects its debt obligations to be $165 million.

In the earnings statement, Tripp Grant, the company’s CFO, said Covenant had cash and cash equivalents totaling $54.6 million at the end of the first quarter and no borrowings under the ABL facility. In its 10-K report, Covenant said it had cash on hand of $68.6 million as of Dec. 31, a huge increase from the $8.4 million it had a year earlier.

In the statement, Covenant Chairman and CEO David Parker said it sought to buy Lew Thompson “because of their proven track record of operating a first class dedicated contract carrier business in a niche market, which we believe has less sensitivity to economic cycles and opportunities to grow.”

As far as Covenant’s earnings, like other transportation companies this quarter it saw several key numbers deteriorate. But the end performance was hardly a bloodbath.

The bottom line at the company is that diluted earnings per share declined to $1.19 from $1.32 in the first quarter of 2022.

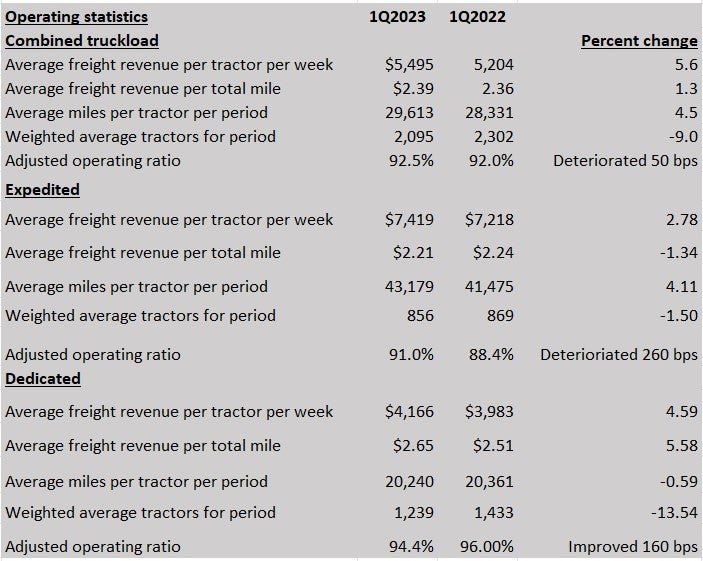

Covenant’s performance as measured by operating ratio was mixed. Its adjusted operating ratio for combined truckload — the Expedited and Dedicated divisions together — weakened just 50 basis points to 92.5%. Expedited adjusted OR slid to 91% from 88.4%, while the Dedicated adjusted OR improved to 94.4% from 96%.

The company’s total freight revenue excluding fuel declined 9.4% to $233.4 million from $257.6 million. But the combined truckload revenue excluding fuel declined just 3.8%, to $148 million.

“The decrease in freight revenue is primarily related to the reduction of the fleet in our Dedicated segments which aligns with our strategy to replace underperforming business with business that meets our profitability requirements,” Paul Bunn, the company’s president and COO, said. “The decrease in tractors was attributable to the exit of underperforming business.”

Dedicated revenue excluding fuel declined to $66.36 million from $73.37 million. Adjusted operating income for Dedicated was $3.7 million, up from $2.9 million despite the drop in revenue.

There also were operational changes in Covenant’s Expedited segment, which the company in its 10-K defined as mostly requiring team drivers to serve “customers with high service freight and delivery standards, such as 1,000 miles in 22 hours, or 15-minute delivery windows.”

Bunn said tractors in Expedited were down 13 units, or 1.5%, from the corresponding quarter of 2022. “The reduction in tractors was an intentional effort by management to adjust the fleet size down in response to the reduced volumes of available freight with expedited service requirements.”

And while Expedited’s revenue excluding fuel rose $1 million to $81.6 million, the adjusted OR climbed to 91% from 88.4%.

In his statement, Palmer used a version of the word that has become the constant theme through trucking earnings season: soft. “The first quarter’s freight market, consisting of a combination of freight rates and volumes, has materially softened compared to a year ago and has remained soft throughout April,” he said.

As for Covenant’s other two segments:

- Managed Freight, which is the company’s brokerage activities, saw big drops in every key measure. Revenue declined to $60.9 million from $86.1 million. Adjusted operating income dropped to $1.3 million from $10.9 million. And the adjusted OR fell more than 1,000 bps to 97.9% from 87.4%.

- Warehousing took in more revenue, up to $245 million from $17.4 million. But its adjusted operating income declined to $250,000 from $13 million, and its adjusted OR was just slightly better than breakeven at 99%, down from 92.5%. Bunn said the drop in profitability “is largely attributable to incremental costs of securing additional unoccupied leased space in key locations, which is consistent with our long term growth strategy.” He also cited “inflationary cost headwinds with existing customers.”

More articles by John Kingston

U.S. Xpress settles class action suit going back to its early IPO days

C.H. Robinson’s Q1 was weak; April’s freight market was no better

Marten drove more in 1st quarter than last year but made less money

The post Covenant buys poultry hauler and reports softer 1st quarter appeared first on FreightWaves.

Source: freightwaves - Covenant buys poultry hauler and reports softer 1st quarter

Editor: John Kingston