Freight News:

Carriers punt on rest of 2022, hopeful for market normalization in ’23

Large carriers have given up on any material improvement in freight demand for the rest of the year. However, some are beginning to call for normal seasonality in 2023 with market tightening as soon as the middle of the year.

No surprise, there is no peak season

Appearing at Baird’s annual global industrial conference in Chicago, management from J.B. Hunt (NASDAQ: JBHT) said an inventory correction is continuing to play out throughout its customer book. An extant overhang of merchandise was exacerbated as some shippers pulled forward orders early this year to avoid the supply chain bottlenecks seen last year.

“2022 so far is … the most muted version of peak season that I can recall in my career. We just don’t have a significant surge in demand,” said Darren Field, who runs the company’s intermodal segment.

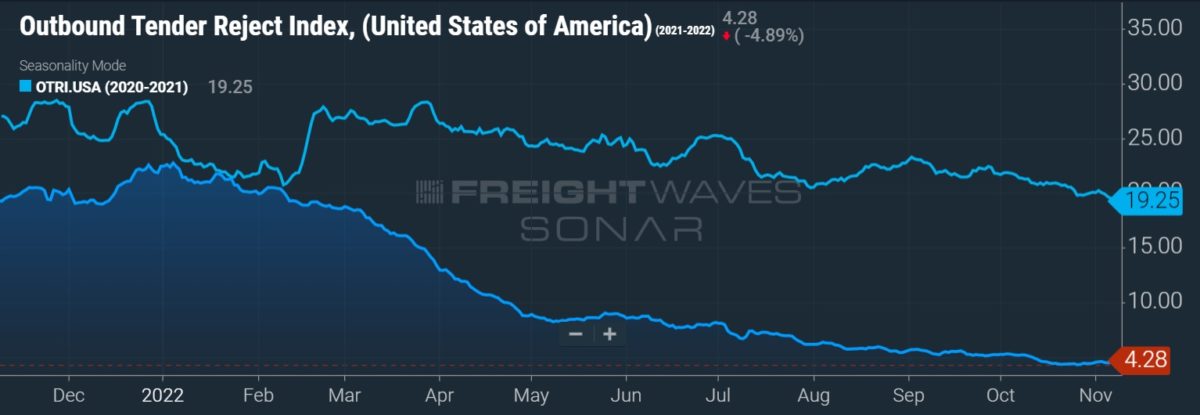

Schneider National (NYSE: SNDR) CFO Steve Bruffett said volumes have been moving sideways for a few weeks now without a normal seasonal uptick. He said Schneider is accepting the majority of the loads tendered to it daily compared to only a 50% acceptance rate this time a year ago.

The company is planning for more of the same for the rest of the year with the expectation that more normal seasonal patterns take hold in early 2023. Bruffett believes conditions will improve in the second half of the year and is holding out for a favorable inflection point as early as the spring.

Noting difficult year-over-year (y/y) comps in the fourth and first quarters, Werner Enterprises’ (NASDAQ: WERN) leader also expects more typical seasonal trends next year.

“Peak is certainly muted right now compared to what we’ve seen in prior years. There’s no debate about that really at this point,” Derek Leathers, Werner’s chairman, president and CEO, told investors on Wednesday.

Leathers said normal peak and project opportunities are down 70% compared to 2021. However, demand for its dedicated and other contractual business is holding up well. The company is highly exposed to freight in the discount retail, home improvement and food and beverage sectors, which tend to remain firm in downturns.

Cost inflation driving capacity out quickly

“From my perspective, it’s a very painful time to be a small carrier,” Leathers said.

Spot market dependent carriers have seen rates drop 40% (excluding fuel) since a February peak. Over the same time, most expense lines have continued to increase.

“Over the last several years, [small carriers] went out and paid too much for their equipment, at a time now when interest rates are rising, at a time when fuel is higher than it’s been ever before and the efficiency of their equipment, because of its age, is not really competitive,” Leathers continued. “The insurance line isn’t getting any better, and they did all that wrapped inside of a pursuit of the spot market.”

He pointed to more than 10,000 net deactivations of operating authorities over the last five weeks as evidence that cost inflation is quickly forcing carriers out of business. He also said the company’s power-only brokerage offering has seen an increase in driver interest over the same time.

Bruffett said he’s seeing some carriers leave the market but nothing material yet.

“I wouldn’t call it overwhelming evidence of an exiting of small carrier capacity,” he said. However, Bruffett noted some carriers are trying to “tough it out” through year end, awaiting signs of potential market improvement, before making a decision.

He too sees cost inflation next year but likely at a more subdued pace.

This down cycle may prove shorter in duration as the industry was unable to oversupply capacity as it has done in prior downturns. Production headwinds at the OEMs limited heavy-truck deliveries and extended trade cycles throughout the pandemic. Leathers said 2023 is likely to be another year of sub-replacement level builds due to parts and components shortages as well as Europe’s struggles with sourcing energy to power vendor manufacturing sites.

Werner CFO John Steele highlighted the impact higher fuel costs are having on capacity this cycle. Diesel was $2.30 per gallon during the 2015-16 downturn and $3 per gallon in the 2018-19 cycle. The latest weekly retail price was $5.33, according to the Energy Information Administration.

“If you’re small, you got to pay for fuel when you pump it … at that moment,” Steele said. “So, it’s a big cash challenge on their part.”

Bruffett doesn’t think 2023 is a “golden opportunity” but said it doesn’t present a “dire situation” either.

“Either capacity exits quickly and that supports spot price[s] and that’s good for the contractual space or spot price[s] move up and that’s good,” he said.

Leathers thinks the truckload market could be “back in balance, if not tight” by the middle of 2023.

“It’s not going to be an easy year,” he said. “There’s a lot ahead of us, but we’ve got our eyes on the ball and we know what we’ve got to go do.”

Intermodal battle lines redrawn

Field said J.B. Hunt is in position to take advantage of any dislocation in the intermodal market as Schneider changes rail service providers from BNSF (NYSE: BRK.B) to Union Pacific (NYSE: UNP) at year-end. The departure will leave J.B. Hunt as the last remaining full TL provider on BNSF’s line.

An abundance of available space on the rail line, plans to expand its container fleet by nearly 40% and other investments have J.B. Hunt poised to grow its intermodal unit by double-digit percentages over the next decade, according to Field.

Further, improved rail service and fluidity throughout the network will allow J.B. Hunt to improve box turns. Field said elevated equipment detention times at customer sites are due to a lack of space to store the merchandise and no longer tied to labor constraints, which was the case throughout the pandemic.

As equipment utilization improves, the company will be able to reduce costs, with the savings being shared with customers. Field said a reduced cost structure would allow J.B. Hunt to lower intermodal rates while maintaining margins.

“As we take cost out of the system, I fully anticipate to pass that benefit onto the customer,” Field said.

Currently, only 20% of Schneider’s intermodal volumes are moving on the UP line.

“It’s a big task,” Bruffett said regarding the switch. “It won’t happen in one day or one week. It’s a lot of containers and chassis to move around and drivers to get repositioned. All parties involved have a vested interest in making sure that goes well.”

The move to UP doesn’t change the company’s long-term operating margin targets of 10% to 14%, but Bruffett said it gives them a better path for growth.

“For us, it’s about a growth opportunity and a distinction opportunity that we’re excited about,” he said. “I think that we’ll add to our earnings dollars by maintaining those solid margins and growing volume and revenue.”

During the third quarter, Schneider’s intermodal operating ratio (inverse of operating margin) deteriorated 620 basis points y/y to 90.7%. Duplicate expenses associated with running operations on both railroads and higher drayage costs were the culprits.

More FreightWaves articles by Todd Maiden

- Show-me story Daseke expects to perform through downturn

- Werner acquires ReedTMS Logistics in $112M deal

- Broker Echo ups global freight forwarding game in latest deal

Outbound tender lead times decrease as we enter November

The post Carriers punt on rest of 2022, hopeful for market normalization in ’23 appeared first on FreightWaves.

Source: freightwaves - Carriers punt on rest of 2022, hopeful for market normalization in ’23

Editor: Todd Maiden